Summary: If you’re facing property tax delinquency in Tucson, AZ, you’re not alone. This guide explains how tax-delinquent homes are handled in Pima County and walks you through the consequences and your options—including paying the taxes, setting up a plan, listing with an agent, or selling as-is for cash. Selling as-is may be the fastest way to walk away free and clear, even with liens already in place.

Table of Contents

- Understanding Tax-Delinquent Properties in Arizona

- Consequences of Delinquent Taxes in Tucson

- Your Options

- Documents to Gather

- How an As-Is Cash Sale Works in Tucson

- Tucson-Specific Tips

- Roadblocks & How We Handle Them

- FAQs: Tax-Delinquent Homes in Tucson

- Conclusion

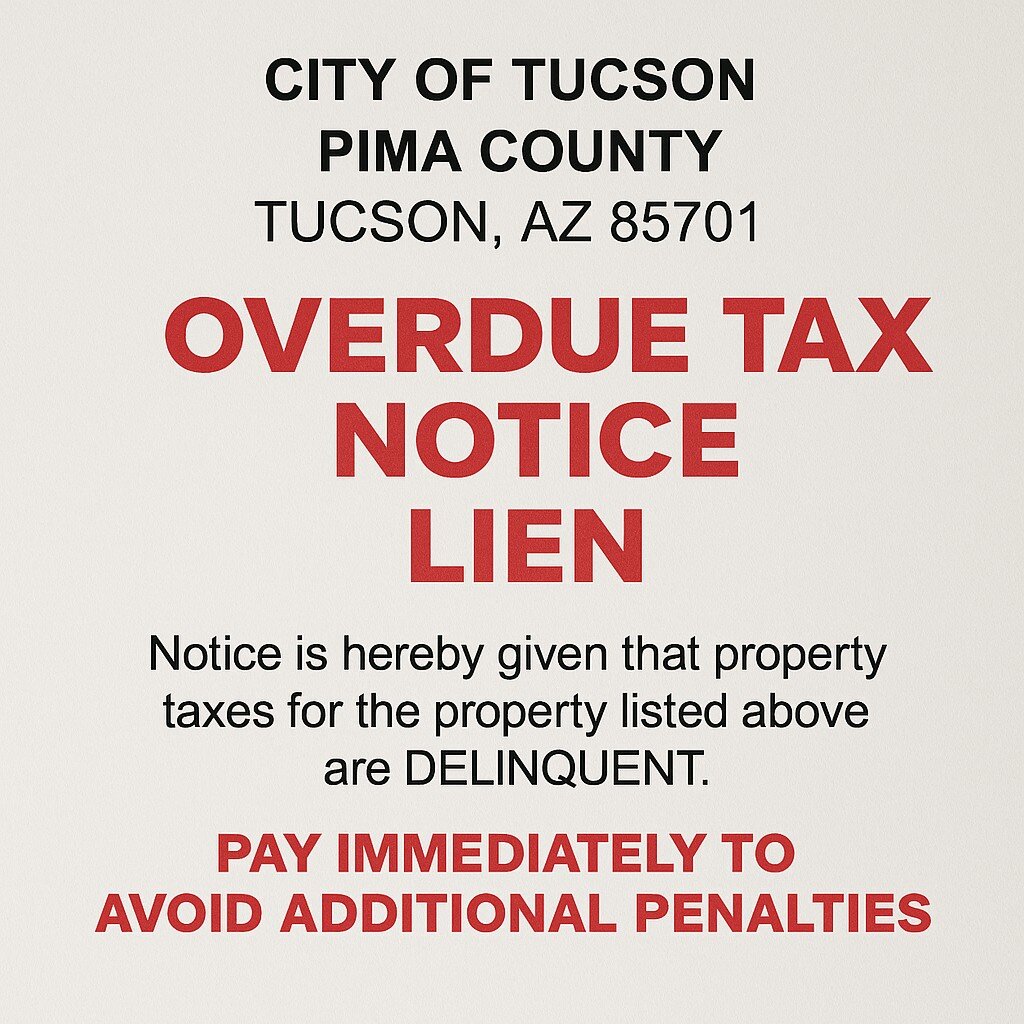

If you’ve fallen behind on your taxes, you may be feeling overwhelmed and worried about losing your home. While this situation can be scary, you’re not alone. In fact, it’s more common than you think, with many Tucson homeowners facing uncertainty due to unpaid taxes.

The good news is that you have options before the county or a lien buyer takes further action. In this article, we’ll discuss how the city of Tucson handles tax-delinquent properties and your options for moving forward.

Everyone faces challenging times, but with the right guidance, you can make the best decision for your future. If you’re exploring your options, you can also learn more about selling your house fast in Tucson.

Understanding Tax-Delinquent Properties in Arizona

In Tucson, homeowners must pay property taxes on their homes. The payments are made in two installments, the first in October and the second by March 1st. If you fail to make the first payment, it’s considered delinquent by November 1st, while the second enters delinquency by May 1st.

If both installments are unpaid by their due dates, the Pima County Treasurer begins assessing penalties and interest, which is known as a tax lien. After three years from the original date of delinquency, the county begins a tax lien certification process. The tax lien certification process allows private investors to bid on the right to hold your home’s tax lien.

The investor then pays the property’s delinquent property taxes to the county, and it becomes your job to repay them. The reason why this process can be so financially devastating to homeowners is that you now have to repay both the penalties and interest that have accrued from your original property tax delinquency, plus up to 16% interest on the lien to redeem your home back from the investor.

If you fail to redeem your property within the specified period (which varies case by case), the lien holder can initiate foreclosure. They may also pursue a tax deed, allowing the investor to gain ownership over the property.

Consequences of Delinquent Taxes in Tucson

Since many Tucson residents face tax delinquency, it’s important to understand the consequences that come with falling behind on property tax payments.

Interest and penalties add up quickly

One of the factors that makes tax delinquency so challenging is how quickly the interest and penalties add up. Before you know it, you could face thousands of dollars in additional expenses that make it even harder to pay off.

For example, the tax delinquent interest rate in Arizona is 16% annually or 1.333% per month for the total delinquent amount. Interest begins to accrue on the day after the tax due date. There’s also a $5.00 penalty on taxes not paid by the following January from the initial due date. What do these fees look like?

Let’s say you have a property tax bill of $2,000 and you don’t make a payment. You’ll owe $2,026.66 the following month. The next month’s interest is calculated from the $2,026.66, not the original $2,000, with each subsequent month’s payment calculation coming from the new, higher amount. That means, on the second month, you’ll owe $2,053.01, and so on. You’ll also have the $5.00 penalty.

As you can see, since the interest rate is compounded, it quickly adds up, causing you to owe significantly more than the original amount.

Clouded title makes refinancing or selling traditionally difficult

If you haven’t paid your property taxes, your home’s title becomes clouded. A clouded title simply means that there’s a lien, unresolved claim, or legal defect that interferes with the property’s unencumbered and free ownership.

Having a clouded title makes it difficult or even impossible to transfer the property’s title to a new owner, which makes refinancing your mortgage or selling on the traditional market incredibly difficult.

Failure to redeem = risk of foreclosure after 3 years

If you fail to redeem your property from the investor who purchased the tax lien, you could face foreclosure after 3 years. The person or company holding the lien can choose to sell the property or gain ownership, leaving you in a very difficult situation.

Your Options

While the consequences of having delinquent taxes in Tucson are severe, you do have options. Let’s go over each one in more detail below.

Redeem taxes & keep the home: Pay back taxes plus penalties

Your first option to avoid possible foreclosure on your home is to redeem it by paying your back taxes and penalties. Depending on the length of the delinquency, this amount can range from a few thousand to tens of thousands of dollars. While this option is often unachievable for most Tucson homeowners, it’s a great way to reclaim your home quickly.

Payment plan with Pima County (if eligible)

If you are eligible, you can set up a repayment plan for delinquent taxes with the Pima County Treasurer’s Office. While some jurisdictions have multi-year, formal installment programs, in Arizona, there are specific laws for paying delinquent taxes.

Eligibility is determined by individual tax situations and your ability to create and maintain your payment plan. Who may qualify for this option?

- Homeowners with delinquent property taxes

- Those able to make consistent payments; one missed payment will cause the plan to default.

- Homeowners with no pre-existing tax lien on the property or those actively selling it due to the delinquent taxes.

To apply for a tax delinquent payment plan, you’ll need to contact the Pima County Treasurer’s Office and provide them with the property information and your unique tax number. If you qualify, they’ll work with you to create a plan that fits your individual financial situation.

List with an agent

Listing your home with an agent is another option when facing delinquent taxes. While selling your property with a realtor can work, it requires you to clear the lien first, and the process is often slow. For those struggling to make their tax payments, this method is often not the best fit.

Sell as-is for cash

Selling your home as-is for cash is the fastest way to resolve liens at closing and walk away with your remaining equity. When you use a trusted company, you receive fair market value on the sale of your home and enjoy fast closings, generally taking only a couple of weeks from start to finish.

Documents to Gather

When selling your home after tax delinquency, it’s important to gather all the required documents to help the process go quickly and smoothly. The list below identifies which records you’ll need.

Pima County Treasurer’s delinquent tax statement – You’ll need to have your home’s tax delinquent statement from the Pima County Treasurer on hand.

Redemption status – If your tax lien is already sold, be sure to provide the redemption status paperwork.

Deed & ID – You’ll need to show the property’s deed and your ID for identification purposes.

Mortgage payoff and HOA info (If applicable) – If you have an outstanding balance on your mortgage, you’ll need to show the payoff amount and include any applicable HOA information.

How an As-Is Cash Sale Works in Tucson

An as-is cash sale is the fastest and easiest way to sell your home and free yourself from the weight of property tax delinquency. With Red Rock Properties, the process is simple and only requires a few steps.

Step 1 – Fill out short form or call Red Rock Properties

To start, fill out our short questionnaire or call our experienced team.

Step 2 – Quick walkthrough (no repairs or showings)

We only have to do one quick walkthrough of the property, so you don’t have to deal with annoying showings or worry about costly repairs.

Step 3 – Receive a fair cash offer factoring in delinquent taxes

After our walkthrough, we’ll provide you with a fair all-cash offer, based on your home’s current market value and factoring in your tax delinquency.

Step 4 – Title company pays off back taxes at closing

Once you’ve accepted your offer, our title company will pay off all of your back taxes at closing.

Step 5 – Seller receives remaining balance

After your taxes are paid, you’ll receive the remaining balance from the sale of your home. The entire as-is sale process only takes days, not months, so you get your cash payment fast!

Tucson-Specific Tips

When facing property tax delinquency in Tucson, consider the following tips.

1. Check your parcel on the Pima County Treasurer’s website to see redemption deadlines

It’s vital that you stay informed on your redemption deadlines to avoid your home going into foreclosure.

2. Don’t ignore notices—the longer you wait, the more expensive it gets

While it can be very overwhelming, it’s important that you don’t ignore notices. Ignoring them won’t make them go away, and the longer you wait, the more money you’ll owe.

3. Keep utilities on to protect the property’s condition while you decide

Turning off your home’s utilities can cause damage to the property and lower its value. To ensure you get the best value for your situation, keep all utilities on while deciding how to move forward.

Roadblocks & How We Handle Them

At Red Rock Properties, we’ve helped countless Tucson homeowners facing property tax delinquency. Our team has the experience to handle any roadblock you may face.

Multiple years of unpaid taxes → cleared at closing

Even if you haven’t paid your property taxes in years, we can make it right. We factor in your delinquent taxes with your all-cash offer and pay them off at closing.

Combined probate + tax delinquency → title can handle both

Even if you have probate and title delinquencies, we will handle both, leaving you free and clear.

Investor already holds lien → still resolvable in most cases

In the vast majority of cases, we can still resolve your delinquency even if an investor already holds a lien.

FAQ

Can I sell a tax-delinquent house in Tucson as-is?

Yes. A cash buyer can purchase the property and pay off the delinquent taxes at closing.

Do I have to pay all back taxes before selling?

No. In most cases, the taxes are deducted from your proceeds at closing.

What if a tax lien investor already holds my lien?

The lien can still be cleared during the sale through the title company.

How long before Pima County forecloses for taxes?

In Arizona, investors can start foreclosure after a 3-year redemption period.

You don’t have to face property tax delinquency on your own. Red Rock Properties has helped countless Tucsonans free themselves from the weight of owing back taxes with fair, as-is cash sales on their homes. Discover how we can help you with your all-cash offer. Contact our knowledgeable team at 480-389-6484 or visit our Tucson buying home page today!

![we buy houses for cash [market_state]](https://image-cdn.carrot.com/uploads/sites/77125/2023/12/We-Buy-Houses-Cash-Home-Buyers-Arizona.jpeg)